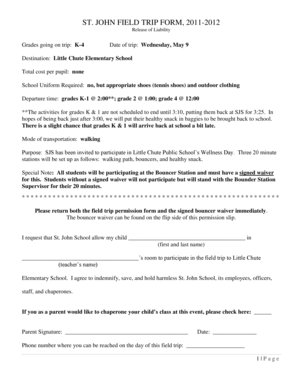

Canada NR73 E 2012 free printable template

Show details

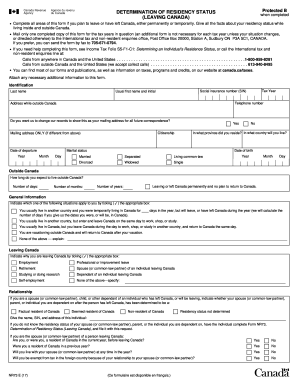

DETERMINATION OF RESIDENCY STATUS (LEAVING CANADA)

Complete all areas of this form if you plan to leave or have left Canada, either permanently or temporarily. Give all the facts about your residency

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 73 for revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 73 for revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 73 for revenue online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 73 for revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Canada NR73 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 73 for revenue

How to fill out form 73 for revenue:

01

Start by carefully reading the instructions provided with form 73. It is important to understand the requirements and gather all the necessary information before filling out the form.

02

Begin by entering your personal information, such as your name, address, and contact details, in the designated fields on the form.

03

Provide the relevant financial details as required by form 73. This may include reporting income earnings, expenses, deductions, and any other financial information necessary for calculating revenue.

04

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or missing information can result in delays or even penalties.

05

Once you are confident that all the information is correct, sign and date the form. If necessary, include any additional documentation or supporting materials as instructed by the form.

06

Finally, submit the completed form 73 to the appropriate revenue authority or follow the instructions provided for filing and submitting the form electronically.

Who needs form 73 for revenue?

01

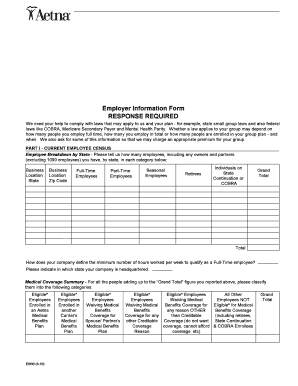

Individuals running a business: Form 73 for revenue is often required for individuals who operate their own businesses. It helps to report and calculate the revenue generated and any associated taxable income.

02

Self-employed professionals: Freelancers, consultants, and other self-employed professionals may also need to fill out form 73 as part of their tax obligations. This form allows them to accurately report their revenue and taxable income.

03

Partnerships and small companies: Form 73 is necessary for partnerships and small companies to report their revenue and financial information accurately. It helps these entities fulfill their tax obligations and ensures transparency in their financial reporting.

04

Corporations and larger organizations: Depending on the jurisdiction, corporations and larger organizations may also be required to file form 73 for revenue purposes. This form helps them disclose their revenue and financial information to the respective tax authorities.

Note: It is important to consult with a tax professional or government entity to determine specific requirements and regulations related to form 73 for revenue in your jurisdiction.

Fill form : Try Risk Free

People Also Ask about form 73 for revenue

Is T3 and T5 the same?

What is a NR73 form?

What is the difference between a T3 and T5 tax slip?

What is line 73 on a Canadian tax return?

What is the difference between T5 and T3 tax?

Is NR73 necessary?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 73 for revenue?

There is no specific form 73 for revenue that I am aware of. The forms used for reporting revenue vary depending on the country and the specific requirements of the tax authorities. In the United States, for example, businesses may report revenue on their tax return using Schedule C (for sole proprietors), Schedule K-1 (for partnerships), or Form 1120 (for corporations). It is recommended to consult with a tax professional or the appropriate government agency in your country to determine the specific form for reporting revenue.

Who is required to file form 73 for revenue?

Form 73 is not a recognized form for revenue filing. There is no specific form 73 related to revenue filing. It is possible that you may be referring to a form specific to a certain country or organization. Please provide more information or clarify your question for a more accurate response.

How to fill out form 73 for revenue?

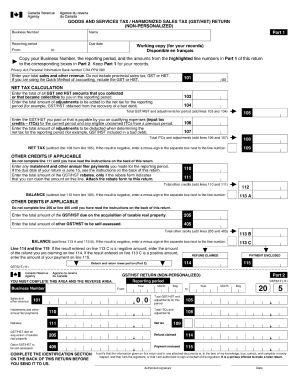

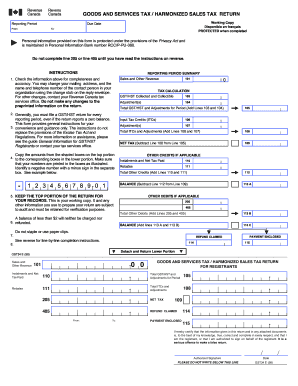

Form 73 is used for the income tax return of individuals and corporations in certain Canadian provinces. However, since you haven't mentioned which province's revenue the form is for, I cannot provide specific instructions. Nevertheless, here are some general steps you can follow to fill out a tax form:

1. Gather all necessary documents: Ensure you have all the relevant paperwork, including T4 slips, receipts, and any other documents related to your income and expenses.

2. Read the instructions: Review the instructions provided with Form 73, as it will contain detailed guidelines and information about the specific requirements for your province's revenue.

3. Provide personal information: Fill out all personal details, including your name, address, social insurance number (SIN), and fiscal period (if applicable).

4. Income details: Enter your income from various sources, such as employment, self-employment, investments, rental income, and any other applicable categories.

5. Deductions and credits: Claim deductions and credits that you are eligible for, such as medical expenses, charitable donations, tuition fees, or any other applicable deductions.

6. Calculate taxes owed or refund: Determine the amount of tax you owe or the refund you are eligible for based on the information you provided.

7. Sign and date: Sign and date the form, certifying that the information provided is accurate and complete.

8. Submit the form: Mail the completed form to the appropriate tax authority for your province's revenue. Be sure to keep a copy for your records.

Remember, these steps are general instructions, and the specific requirements and sections of Form 73 may vary based on your province. It is always recommended to review the instructions provided with the form and consult a tax professional for personalized assistance if needed.

What information must be reported on form 73 for revenue?

Form 73 is a fictional or unidentified form. Therefore, it is not possible to provide specific information on what must be reported on this form for revenue. If you have more details about the form or its purpose, I can try to assist you further.

When is the deadline to file form 73 for revenue in 2023?

I apologize, but I couldn't find any specific information about a form 73 for revenue filing in 2023. It is possible that the form number or requirement may vary depending on the country or region you are referring to. To get accurate information about the deadline and specific requirements, I would recommend reaching out to the relevant tax or revenue authority in your jurisdiction.

How can I send form 73 for revenue to be eSigned by others?

Once your form 73 for revenue is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit form 73 for revenue online?

With pdfFiller, the editing process is straightforward. Open your form 73 for revenue in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out form 73 for revenue on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your form 73 for revenue by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your form 73 for revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.